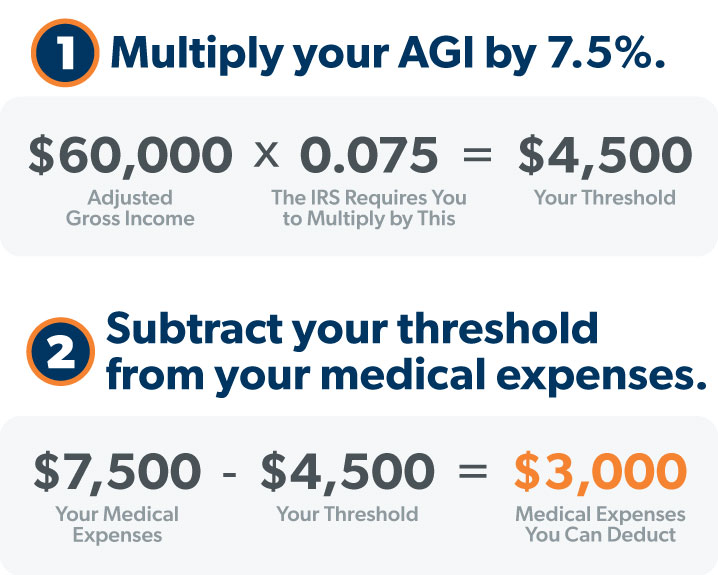

Are Medical Expenses Tax Deductible Usa . How to claim medical expense deductions. The short answer is yes, but there are some limitations. This interview will help you determine if your medical and dental expenses are deductible. Plus, expenses must be medically. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. Deductible medical expenses may include but aren't limited to the following: Amounts paid of fees to doctors, dentists,. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi).

from www.ramseysolutions.com

Plus, expenses must be medically. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? This interview will help you determine if your medical and dental expenses are deductible. The short answer is yes, but there are some limitations. You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). How to claim medical expense deductions. Amounts paid of fees to doctors, dentists,. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. Deductible medical expenses may include but aren't limited to the following:

Can I Deduct Medical Expenses? Ramsey

Are Medical Expenses Tax Deductible Usa This interview will help you determine if your medical and dental expenses are deductible. Plus, expenses must be medically. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? Amounts paid of fees to doctors, dentists,. You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). How to claim medical expense deductions. The short answer is yes, but there are some limitations. This interview will help you determine if your medical and dental expenses are deductible. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. Deductible medical expenses may include but aren't limited to the following:

From www.pinterest.com

Can I Claim Medical Expenses on My Taxes? TurboTax Tax Tips & Videos Are Medical Expenses Tax Deductible Usa The short answer is yes, but there are some limitations. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. This interview will help you determine if your medical and dental expenses are deductible. If you’re paying a lot of healthcare costs out of your. Are Medical Expenses Tax Deductible Usa.

From www.nicovideo.jp

Which Medical Expenses are Tax Deductible 2020, 2021 ニコニコ動画 Are Medical Expenses Tax Deductible Usa For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. How to claim medical expense deductions. You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). Deductible. Are Medical Expenses Tax Deductible Usa.

From medicaliomt.com

Are medical expenses deductible? Medical IoMT Are Medical Expenses Tax Deductible Usa How to claim medical expense deductions. Deductible medical expenses may include but aren't limited to the following: You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). Amounts paid of fees to doctors, dentists,. This interview will help you determine if your. Are Medical Expenses Tax Deductible Usa.

From flyfin.tax

Top 20 Medical Expense Deductions For 2024 Are Medical Expenses Tax Deductible Usa This interview will help you determine if your medical and dental expenses are deductible. The short answer is yes, but there are some limitations. Deductible medical expenses may include but aren't limited to the following: How to claim medical expense deductions. Amounts paid of fees to doctors, dentists,. If you’re paying a lot of healthcare costs out of your own. Are Medical Expenses Tax Deductible Usa.

From www.dochub.com

Medical expenses tax deductible Fill out & sign online DocHub Are Medical Expenses Tax Deductible Usa For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. How to claim medical expense deductions. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? Plus, expenses must be medically. This interview. Are Medical Expenses Tax Deductible Usa.

From tobicloud.com

Tax Guide for NonEmergency Medical Transportation Businesses Are Medical Expenses Tax Deductible Usa For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. This interview will help you determine if your medical and dental expenses are deductible. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your. Are Medical Expenses Tax Deductible Usa.

From www.capitalone.com

Are Medical Expenses Tax Deductible? Capital One Are Medical Expenses Tax Deductible Usa You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). The short answer is yes, but there are some limitations. Amounts paid of fees to doctors, dentists,. Plus, expenses must be medically. For 2023 tax returns filed in 2024, taxpayers can deduct. Are Medical Expenses Tax Deductible Usa.

From capitalbenchmarkpartners.com

Are Medical Expenses Tax Deductible? Capital Benchmark Partners Are Medical Expenses Tax Deductible Usa For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. How to claim medical expense deductions. The short answer is yes, but there are some limitations. Plus, expenses must be medically. This interview will help you determine if your medical and dental expenses are deductible.. Are Medical Expenses Tax Deductible Usa.

From www.grantsformedical.com

Are Medical Expenses Tax Deductible? 10 Deductible Expenses Are Medical Expenses Tax Deductible Usa How to claim medical expense deductions. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). If. Are Medical Expenses Tax Deductible Usa.

From pansiewgusti.pages.dev

What College Expenses Are Tax Deductible 2024 Dody Nadine Are Medical Expenses Tax Deductible Usa How to claim medical expense deductions. The short answer is yes, but there are some limitations. Amounts paid of fees to doctors, dentists,. Deductible medical expenses may include but aren't limited to the following: You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross. Are Medical Expenses Tax Deductible Usa.

From www.dev.agingcare.com

Can I Deduct Medical Expenses I Paid for My Parent? Are Medical Expenses Tax Deductible Usa Plus, expenses must be medically. Amounts paid of fees to doctors, dentists,. Deductible medical expenses may include but aren't limited to the following: If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? The short answer is yes, but there are some limitations. How to claim medical expense. Are Medical Expenses Tax Deductible Usa.

From www.ramseysolutions.com

Can I Deduct Medical Expenses? Ramsey Are Medical Expenses Tax Deductible Usa This interview will help you determine if your medical and dental expenses are deductible. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? How to claim medical expense deductions. Deductible medical expenses may include but aren't limited to the following: Amounts paid of fees to doctors, dentists,.. Are Medical Expenses Tax Deductible Usa.

From www.youtube.com

How Can I Make Health Expenses Tax Deductible? YouTube Are Medical Expenses Tax Deductible Usa For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. How to claim medical expense deductions. The short answer is yes, but there are some limitations. This interview will help you determine if your medical and dental expenses are deductible. Plus, expenses must be medically.. Are Medical Expenses Tax Deductible Usa.

From www.pinterest.com

Are you unsure what expenses are deductible for you business? This Are Medical Expenses Tax Deductible Usa You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). The short answer is yes, but there are some limitations. Amounts paid of fees to doctors, dentists,. If you’re paying a lot of healthcare costs out of your own pocket, can you. Are Medical Expenses Tax Deductible Usa.

From www.mytaxrebate.ie

Medical Expenses Tax Back Get 20 tax back today! My Tax Rebate Are Medical Expenses Tax Deductible Usa This interview will help you determine if your medical and dental expenses are deductible. If you’re paying a lot of healthcare costs out of your own pocket, can you deduct those medical expenses from your taxes? Amounts paid of fees to doctors, dentists,. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more. Are Medical Expenses Tax Deductible Usa.

From www.dmtax.ca

All You Need To Know About Claiming Medical Expenses On Your Personal Are Medical Expenses Tax Deductible Usa Plus, expenses must be medically. Deductible medical expenses may include but aren't limited to the following: You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). The short answer is yes, but there are some limitations. If you’re paying a lot of. Are Medical Expenses Tax Deductible Usa.

From azexplained.com

What Health Care Costs Are Tax Deductible? AZexplained Are Medical Expenses Tax Deductible Usa For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. How to claim medical expense deductions. You can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). Plus,. Are Medical Expenses Tax Deductible Usa.

From medicarehero.com

Medicare Costs For 2023 Medicare Hero Are Medical Expenses Tax Deductible Usa This interview will help you determine if your medical and dental expenses are deductible. For 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. Deductible medical expenses may include but aren't limited to the following: If you’re paying a lot of healthcare costs out of. Are Medical Expenses Tax Deductible Usa.